of electricity across

our managed portfolio

procured from

renewable sources (1)

At Royal London Asset Management our long-term investment approach, coupled with a relentless focus on maximising value, means that Responsible Property Investment (RPI) is integral to our mindset.

Our RPI Strategy report details our commitments and achievements in embedding more ambitious environmental and social performance goals across our property investment portfolios. Our 2023 report (which covers January to December 2022) emerged from a period of increased uncertainty including the rebound from the pandemic, war, rising energy prices and a cost-of-living crisis.

Against this backdrop, the impact of climate change on our planet continues to become more prominent. And at Royal London Asset Management, we are more conscious than ever of the challenges faced by our occupiers and the communities in which we operate.

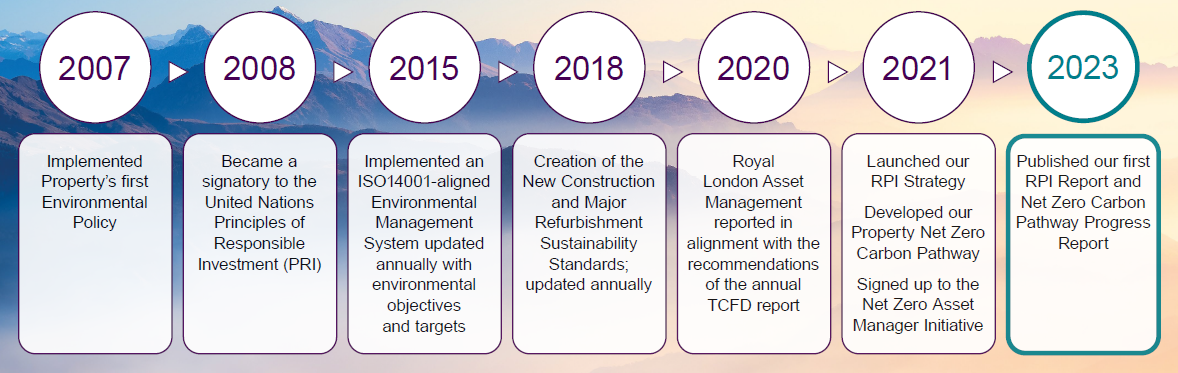

Our RPI journey

Since our first environmental policy in 2007, we have continued to strengthen our commitment to integrating Environmental, Social and Governance (ESG) issues within our approach to property investment.

Our RPI Reports provide an update of overall performance against previous RPI strategies, and lay out our objectives for investors and stakeholders, including the new portfolio targets that are aligned to our previously identified material RPI issues.

Our achievements

100%

117

biodiversity initiatives

implemented across

our managed portfolio

42%

energy data coverage

across the portfolio by floor area

28%

absolute reduction in

Scope 1 and 2 emissions

compared to our Net Zero Carbon Pathway baseline year (2019) (2)

Carbon audits

Undertook our first net

zero carbon audits

across eight offices

SPV study

Solar photovoltatic

(PV) feasibility study

undertaken across over

120 assets

Working group

Reintroduced our

quarterly RPI Working

Group

(1) Through the use of Renewable Energy Guarantees of Origin (REGO) certificates

(2) Absolute changes

Climate and net zero

We recognise that climate change is one of the most pressing challenges facing the world today. Real estate is a significant contributor to greenhouse gas emissions, and we are committed to playing our role in limiting and mitigating the impact of climate-related issues where possible.

We have committed to achieving net zero carbon by 2030 for our directly managed property assets and developments, and 2040 for our indirectly managed property assets*. Our Net Zero Carbon Pathway Progress Report details our progress against our net zero strategy.

* Directly managed assets are those over which Royal London Asset Management has complete operational control, greater than 50% equity share and joint ventures where they would cover the proportionate amount of emissions. Indirectly managed assets are either partially managed by Royal London Asset Management or managed wholly by the occupier. Developments are any new development or major refurbishment that comes online from 2030 onwards.

Our RPI pillars

Pillar One: Investing in a resilient portfolio

Across our portfolio we strive to make considered, future-proofed investment decisions. The ultimate objective is to shape resilient portfolios that meet the current needs of our occupiers and investors, and evolve with their needs and expectations over time.

![]()

Case study: WiredScore certification

WiredScore is a rating scheme within real estate for certifying digital connectivity and smart technology. A WiredScore certification helps demonstrate how digitally enabled a building is, something that is critical for many occupiers today. WiredScore assesses buildings for a range of ESG and resiliency measures, including:

- Resilience – measuring if potential outages are mitigated through resilient critical digital infrastructure

- Occupier experience – ensuring that the building provides occupiers with seamless digital connectivity to enhance their occupier experience

- Future readiness – measuring capacity and flexibility to adapt to new and advancing building technologies

- Reporting and disclosure - whether the building has the right technology and infrastructure to monitor, measure, report on and deploy automation to improve environmental metrics

The certification is also recognised by Global Real Estate Sustainability Benchmark (GRESB) as an accredited green building certification, contributing towards our GRESB assessment input.

As of December 2022 we had five buildings totalling 599,000 square feet certified to WiredScore. Three are WiredScore Occupied, rated Platinum, and two are WiredScore Development, rated Gold and Platinum. Three additional assets are under certification, which will take our total certified coverage to over 919,000 square feet upon completion.

Pillar Two: Developing for the future

We continuously seek to hold ourselves to high standards when it comes to sustainable property development. We aim to build and refurbish high quality assets for our investors, and to create thriving spaces that attract and retain occupiers, while adding value to the local community in which they are situated.

![]()

Case study: The Earnshaw, London

This was an 85,000 square foot 1950s office building with fragmented floorplans, dated finishes and obsolete electrical services. An asset management strategy was devised for The Earnshaw site to enable redevelopment of a new ‘best-in-class’ office building of 155,355 square feet across 12 levels.

The revised development saw a 70% uplift in floor area in a high amenity location, with sustainability and occupier-focused improvements in line with our New Construction and Major Refurbishment Sustainability Standards, including:

- Fully electric building with solar PV panels included on the roof, targeting Net Zero Carbon in operation

- Emphasis on natural daylight for energy saving purposes as well as occupier wellbeing and productivity

- Supporting active transport with the installation of over 230 bike spaces and end-of-trip facilities

- Targeting credentials including EPC rating of A, BREEAM Outstanding and WiredScore Platinum

A key part of the sustainability and occupier strategy for The Earnshaw was a focus on health and wellbeing, with a target of achieving a WELL Gold rating. Achieving WELL certification is a stringent process. The health and wellbeing benefits for occupiers include:

- a focus on improving air quality

- enhancing natural daylight

- promoting indoor comfort via enhanced acoustic performance

- internal temperature and humidity controls

- encouraging connection to nature and restorative spaces

- and providing opportunity for relaxation and positive physical and mental wellness.

In December 2022, The Earnshaw was pre-let to GSK for its new headquarters. The Earnshaw not only provides office amenities in a highly desirable location, but also supports the occupier’s sustainability objectives and its emphasis on health and wellbeing for its staff.

Pillar Three: Managing assets for positive impact

Critical to the ongoing success of our RPI Strategy is collaborating with our stakeholders when managing our assets to deliver positive social and environmental outcomes. We focus on effective collaboration and partnerships with a range of stakeholders, including our occupiers, managing agents, and local stakeholders who are active within the areas and communities in which we operate.

![]()

Case study: Evolving our ESG database

Robust and trustworthy ESG data is crucial for making effective and purposeful decisions. However, due to the scope and scale of our ESG programmes, the level of ESG data available across our properties had rapidly grown to a state where we needed to consolidate it to make it more effective, and easier for multiple stakeholders to use.

Our goal was for asset managers to use this data to create asset-level KPIs to improve the ESG profile of their property. In addition, we have found it insightful when comparing the ESG credentials stored in the database with the property’s operational energy usage to see if they align.

The ESG database contains a common area to document the key ESG criteria of each asset, including building characteristics, certifications and ratings, and a range of indicators specific to each of the material issues that we cover within our RPI Strategy. It also indicates the data source, allowing any new user of the database to easily identify where they could look to find this information, if required.

We have also taken advantage of this data consolidation process to score each asset. To do so, we assigned each ESG criteria a score and weighting, which was sector dependent.

For example, cycle storage facilities are more important for our office assets, whilst solar PV and electric vehicle (EV) infrastructure is more material for retail and industrial properties.

This score gives asset managers a starting point and an indicator of where to prioritise future efforts. We ask for all information at the acquisition stage, and our new Sustainable Acquisition Checklist has been cross-checked to ensure we are covering all important information.

To date, we have consolidated ESG information across our multi-let offices, and our focus this year is to continue updating the database for use in developing asset-level KPIs.

Pillar Four: Responsible-decision making

At the heart of our commitment to RPI is a culture of strong corporate governance and informed decision-making. We are dedicated to ensuring that RPI policies and practices are integrated throughout our property fund management operations, from data gathering and reporting to benchmarking, training, and performance management.

Global Real Estate Sustainability Benchmark (GRESB)

GRESB is a global benchmark for ESG management and performance data across the real estate industry. To maintain transparency with our investors and stakeholders, we submit RPI data and information from each of our funds to the GRESB Real Estate Assessment on an annual basis, aiming to continually enhance the completeness of our data.

Our three property funds submitted data to GRESB in 2022, with the following outcomes:

- Royal London UK Real Estate Fund: Achieved a 4-Star rating on a scale of 1–5 stars, with an overall score of 82, and was ranked third out of its peer group. The fund also achieved a 4-Star rating in the Development benchmark, being ranked fifth in its peer group.

- Royal London Property Pension Fund: Maintained its 3-Star rating, with an overall score of 77 and ranked 13th place in its peer group. The fund also achieved a 5-Star rating in the Development benchmark, second in its peer group, improving from a 4-Star rating and third in its peer group in 2021.

- Royal London Property Fund: Maintained its 3-Star rating, with an overall score of 73 out of 100 and ranked 28th out of its peer group.

![]()

Case study: Green Apple Awards

The Green Apple Environment Awards are designed to recognise, reward and promote environmental best practices around the world. In 2022, we achieved 14 Green Apple Environment Awards and two Commended Awards in the Property Management sector, across a range of categories.

Some specific examples of these properties and their environmental initiatives include the following which all received Gold Green Apple Environment Awards:

- Renaissance, Croydon – green energy and chemical free cleaning: At this property there are 71 solar panels. This project sought to move to chemical-free cleaning of the solar panel system, and installed a natural cleaning system. This resulted in 90% less plastic bottles required as well as a reduction in potential chemical effluents into the environment.

- Wilmslow Campus – community engagement: We engaged with a local school to help students learn about the importance of wildlife. We provided talks, a wildlife tour of a local site, and then helped them build a bug hotel and plant seeds. The children were highly engaged, and we will be inviting the school back again next year to continue this engagement.

- Lower Precinct Shopping Centre – eco sculpture project: To highlight both the importance of recycling to the general public and promote the centre’s sustainability values, the centre team facilitated an art-based sustainability and recycling campaign. With the help of a local artist, we conducted craft workshops with local students to construct a sculpture made entirely from recycled or repurposed materials. This sculpture, combined with a series of shopping centre events under the theme of ‘Sustainable September’, provided a positive conversation starter around environmental issues, bringing together community members to discuss a common challenge.

Whilst receiving awards is a small part of demonstrating our achievements, we are proud of our colleagues and stakeholders in being recognised for their efforts and positive environmental impact. We encourage and continue to support our property managers in promoting positive environmental initiatives at assets across our portfolio.

Documents

Current reports

- Climate (TCFD) report 2022 - Property Product Report

- New construction and major refurbishment sustainability standards

- Property environmental management objectives and targets 2024

- Property Net Zero Carbon Pathway Progress Report 2022

- Responsible Property Investment Report 2022

- Property development and refurbishment statement of achievement 2022